What to Consider before the Best States to Buy Land?

While the ranking of the best states to buy land in the USA may vary slightly each year, the overall trends tend to persist for decades. Factors such as demographics, employment prospects, climate, and state taxes play significant roles in shaping these trends. These factors typically undergo gradual changes, if at all, and as a result, investments that are considered favorable this year are likely to remain lucrative for many years to come.

Things to do before the Best States to Buy Land?

The most crucial factor to consider when deciding where to buy land is what aligns with your personal preferences and motivations. Your reasons, such as proximity to family and friends, work opportunities, and leisure activities, will play a significant role in your decision-making process.

It’s important to examine your unique motivations for buying land, as there may be personal factors that outweigh the considerations presented in any given list. These personal reasons should be taken into account, as they hold great significance in determining the best location for you.

Furthermore, there’s no requirement to limit yourself to purchasing only one parcel of land. You might choose to buy land in your home state due to familiarity with the area, knowledge of its favorable soil for farming, or potential for future development based on your local expertise.

Later on, you might find that the process of buying land in the best states was relatively straightforward and affordable, prompting you to diversify and expand your holdings across different states. These additional parcels could be in emerging areas, hunting grounds, vacation spots for your family, or even for establishing a self-sufficient off-the-grid lifestyle.

The choice of destination will largely depend on whether you are an investor seeking to make a profit in the future or if you have personal reasons driving your decision. In some fortunate cases, multiple reasons may align. For instance, your family’s move to Reno for job opportunities might coincide with your desire to escape New York’s cold winters and live in Nevada for part of the year.

Check out the state and the area before you go.

When looking for the best states to buy land for investment purposes, the specific location and detailed examination may not be as crucial unless you have specific criteria in mind. For instance, if you anticipate that Reno is on the verge of a significant growth period, you may want to acquire land within a 30-minute radius of the city. Alternatively, if you have a favorable outlook on Nevada as a whole, you might aim to purchase as much affordable land as possible throughout the state and hold it for the long term.

On the other hand, if you are looking for the best states to buy land to reside there yourself, it is highly recommended to spend time in the area before making a decision. Familiarize yourself with the neighboring towns and assess the availability of essential facilities such as gyms, supermarkets, healthcare services (doctors and hospitals), recreational amenities, and social clubs. This on-the-ground exploration will provide valuable insights into the livability and convenience of the area for your personal needs.

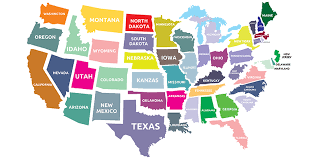

Best States To Buy Land In The USA

The United States offers numerous fantastic locations to buy land, and it’s not necessary to limit oneself to just one state. For instance, in certain areas of Nevada or Utah, it may be possible to acquire a small plot of land for just a few thousand dollars or even less.

While Florida and Texas may require a slightly higher investment, the cost is still significantly lower compared to saving up for a lifetime to purchase a house in the city with the hope of eventually moving out and creating a homestead on land.

Texas: Best States to Buy Land

Texas has consistently remained a popular choice for land buyers due to various factors. It boasts a population growth rate of 1.43% and a total population of 28.3 million.

According to the US Census Bureau, five out of the ten fastest-growing cities in the country are located in Texas. While New York leads in terms of added population, Houston ranks second, followed by San Antonio and Austin in the fourth and fifth positions, respectively. Dallas and Fort Worth are not far behind.

Considering these factors, Texas emerges as a highly favorable location to consider for land purchase.

5 Best States to Buy Land Investment Property

Investing in rental properties can be a lucrative source of income, whether pursued as a primary endeavor or a supplementary one. Nevertheless, the profitability of such investments can vary depending on the state in which they are located.

1. South Carolina

In terms of property taxes, South Carolina boasts one of the lowest rates in the country at 0.57%. The average home price is around $170,000, which is approximately 75% of the cost compared to other regions. Despite a recent 1% increase, housing remains relatively affordable. The median household income stands at $54,800.

Around 30% of South Carolinians choose to rent homes, paying an average monthly rent of $922. The state’s population is growing steadily at a rate of 1.27% per year, slightly below the overall employment growth rate of 1.43% across various occupations.

2. Idaho: Best States to Buy Land

In terms of income, Idaho’s median household income is nearly $59,000 and shows an annual growth rate of over 8%. The state’s economy is thriving, ranking among the top in employment opportunities across the United States.

Property values in Idaho are steadily increasing, with prices rising from $230,000 to over $250,000 within a year. Renters in the state typically pay around $900 per month, constituting 28.4% of the total population. The demand for both rental and sale properties is evident as the population steadily grows by 2% annually. Additionally, Idaho has been recognized as the best state for real estate in the United States.

3. North Carolina

North Carolina’s job market is thriving, particularly in major cities like Charlotte and Raleigh, which are home to numerous Fortune 500 companies, attracting top talent. Despite this, the median property values in the state are relatively affordable, averaging $183,200, lower than the national average. The median household income is closer to the national standard at $56,600. Both property values and household income are experiencing an annual increase of nearly 7%.

Regarding property taxes, North Carolina falls near the national average with a rate of 0.90%. Residents have a fixed tax rate of 5.25%. Approximately 34.7% of the state’s population are renters, paying an average monthly rent of $1,234. This figure has increased by over 25% since 2023.

4. Florida: Best States to Buy Land

The state’s population consistently grows at a rate of approximately 1% each year. The median property value in Florida currently stands at $245,000 and is projected to increase steadily over time. This aligns well with the median household income of $59,227, which experienced a growth of around 6%. The average rent in the state hovers around $1,200. Notably, the prices for one- and two-bedroom homes have risen by 38% since 2021.

Around 34% of Florida residents choose to rent homes or apartments, slightly exceeding the national average. The state has experienced a 2.5% increase in employment opportunities, contributing to its appeal to individuals seeking work. However, one drawback of living in Florida is the property taxes, which can amount to around $3,000 on average.

5. Tennessee

One of the appealing aspects of Tennessee is its favorable tax situation, with property taxes at 0.71% and no state income tax. Although the median household income is somewhat lower than in other parts of the country, averaging around $54,800, it is experiencing notable growth of approximately 8% in property values from the previous year. The average price for buying a home in the state is around $191,500.

Approximately one-third of Tennessee’s population are renters, paying an average monthly rent of $910. The state exhibits above-average job growth, with a 4.14% change from 2021. Its population is steadily increasing, with a growth rate just under 1% year over year.

Best States to Invest in Real Estate

Real estate investing involves acquiring properties to generate profits through either selling or renting them out. When it comes to selling, investors may engage in house flipping, which entails purchasing a property at a lower price, renovating it, and then reselling it at a higher price. Alternatively, investors may choose to retain ownership of the property until market conditions are favorable for a profitable sale.

1. Delaware: Best States to Buy Land

Delaware stands out with its relatively low property tax rate compared to other states. In 2022, the average property tax rate was 0.58%, which is below the national average of 1.1%. This can be advantageous for investors as it helps keep expenses down and potentially increases their return on investment.

Lastly, the average home value in Delaware was $355,181 in 2022. While higher than some other states like Kentucky, this price point is still reasonable for real estate investors, especially when considering the state’s economic growth and low property tax rate.

2. Nevada: Best State to Buy Land

In terms of housing, the average home value in Nevada was $484,530 in 2022, which is higher than the national average of $354,639. However, it remains affordable compared to other states with similar job growth rates.

Nevada boasts one of the lowest average property tax rates in the country, standing at 0.55%. This provides tax benefits for real estate investors. Furthermore, the state’s rental vacancy rate was 5.9% in the third quarter of 2022, indicating a high demand for rental properties. With 43% of Nevada households being renter-occupied, finding tenants for investment properties should not be challenging.

Cheapest states to buy land:

Best State to Buy Land

Nevada

This particular state offers a predominantly hot climate with low humidity, which appeals to both residents and visitors. It presents excellent investment opportunities, particularly in southern Nevada, near the borders of California and Arizona, where one can enjoy the proximity to entertainment hubs like Las Vegas. Additionally, northern Nevada attracts those seeking a more serene lifestyle, with rural locations and breathtaking mountain views serving as a backdrop for building their dream homes.

The Best State to Buy Land for Retirement:

The choice of when, where, and how to retire is a significant milestone in life, marking the end of one chapter and the beginning of another, often after years of preparation. It is a moment that brings a mix of excitement and uncertainty, as individuals embark on a new phase of their lives.

- Wyoming

- Colorado

- South Dakota

- New Hampshire

- Maine

Best State to Buy Land for Retirement: Wyoming

Wyoming, the least populated state in the country, stands out as one of the top choices for retirement due to its combination of favorable tax policies, low crime rates, and high quality of living. It is further enhanced by its breathtaking landscapes, which include renowned national parks like Grand Teton and Yellowstone. According to data from Lands of America, Wyoming boasts an average price per acre for property and land that positions it among the ten most affordable states for land purchases in the country.

FAQs: Best state to buy land

Is buying land a good investment?

Buying land can be a good investment under certain circumstances. Here are some factors to consider when evaluating land as an investment:

- Location: The location of the land is crucial. Land in desirable and rapidly developing areas tends to appreciate over time. Consider factors such as proximity to urban centers, infrastructure development, and potential future growth in the area.

- Potential use: Determine the potential uses for the land. Is it suitable for residential, commercial, agricultural, or recreational purposes? Understanding the zoning regulations and development potential of the land can help assess its investment value.

- Market conditions: Assess the current and projected market conditions for land in the area. Look at historical trends and consult with local real estate professionals to gain insights into market dynamics and potential risks.

- Holding costs: Consider the ongoing costs associated with owning the land, such as property taxes, maintenance, and any other expenses. These costs can affect the overall return on investment.

- Long-term perspective: Land investments often require a long-term perspective. Depending on the location and market conditions, it may take time for the land to appreciate significantly in value. Patience and a long-term investment strategy are often necessary.

- Diversification: Land can serve as a diversification tool within an investment portfolio. It can provide a tangible asset that behaves differently from other investment types, such as stocks or bonds.

- 7 Best Places in Virginia to Live for Families

- Best States to Buy Land