Bad Credit Car Loans With Zero Down

When seeking reliable transportation without straining your budget, bad credit car loans with zero down payment are an excellent option. These loans allow you to purchase a car without upfront costs, and specialized auto lending networks can help secure competitive rates and terms, regardless of your credit score.

Contrary to popular belief, there are car dealerships and networks that willingly cater to consumers with poor credit. These dealerships are willing to take on the risk of providing bad credit car loans with zero down because the financed vehicles serve as collateral. If a buyer defaults on payments, the car can be repossessed. With numerous options available, comparing offers allows you to find the best deals for your credit situation, securing a bad credit auto loan with manageable payments and a reasonable interest rate.

How to Get Bad Credit Car Loans With Zero Down Payment

Auto lending networks provide a range of car financing options that may not require a down payment, catering to individuals with damaged credit. These networks connect you with car dealerships in your area or private subprime lenders, offering same-day loan deals. By submitting a single loan request, you can receive competitive offers from multiple lenders competing for your business. Within 24 hours, a local car dealer will contact you to discuss financing options and available inventory. In many cases, you can secure financing and drive away in your new car on the same day.

- 1. Auto Credit Express

- 2. PenFed Credit Union

- 3. RefiJet

- 4. Car.Loan.com Auto Loan

- 5. LendingTree

1. Auto Credit Express

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% – 29.99% | 1999 | 3 minutes | 9.5/10 |

- A network of dealer partners has closed $1 billion in bad-credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have a $1500/month income to qualify

2. PenFed Credit Union

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 5.19% and up | 1935 | 5 minutes | 9.5/10 |

- Auto loan amounts of up to $150,000

- Prequalify in 2 minutes without impacting your credit score

- Refinancing loans saves an average of $191 per month

- 125% financing is available for cash-out refis

- Membership with PenFed Credit Union is a prerequisite for obtaining a loan, but you have the option to apply for membership simultaneously with your loan application.

3. RefiJet

Interest Rate In Business Since Application Length Reputation Score Varies 2016 5 minutes 9.0/10

- Pre-qualifying for a refinance auto loan does not impact your credit score

- Nationwide network of lenders

- They offer you options from lenders that fit your situation

4. Car.Loan.com Auto Loan

Interest Rate In Business Since Application Length Reputation Score Varies 1994 3 minutes 9.0/10

- Offers a free application process with no obligation

- Specializes in providing auto loans for individuals with bankruptcy, bad credit, first-time buyers, and subprime credit

- Provides affordable payment options and does not charge application fees

- Connects a large number of car buyers with auto financing daily.

5. LendingTree

Interest Rate In Business Since Application Length Reputation Score Varies 1998 4 minutes 9.5/10

- Offers auto loans for purchasing vehicles, refinancing existing loans, and lease buyouts

- Works with a nationwide network of lenders

- Matches borrowers with up to 5 lenders that align with their financial profile

- Quick and free application process that takes only a few minutes and does not come with any obligations.

Car Loan With No Down Payment

Bad Credit Car Loans With Zero Down: What Credit Score Do You Need?

Auto lenders and dealers typically don’t have a minimum credit score requirement. They assess creditworthiness based on factors such as credit and payment history, existing debt, and income. Auto loans, being secured, provide lenders with recourse through vehicle repossession if payments are missed, making them more comfortable lending to individuals with poor credit compared to unsecured personal loans.

While consumers with credit scores below 520 may face challenges in finding car financing, lenders still consider applicants in that credit score range. Submitting a loan request to the auto lending networks mentioned above won’t harm your credit score, and you can receive a credit decision quickly.

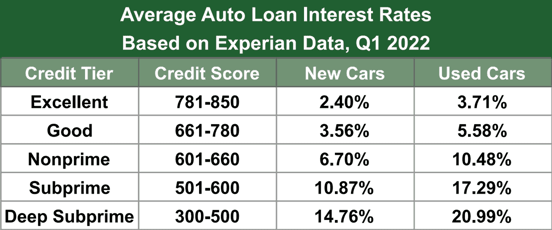

Keep in mind that lower credit scores often result in higher interest rates and fees. Before applying for an auto loan, review your free annual credit report to ensure its accuracy and address any negative items. Maintain low credit card and loan balances, and include all sources of income in your loan application, such as wages, child support, government benefits, and investment income.

Prequalify For Bad Credit Car Loans With Zero Down Online

Having reliable transportation is crucial for daily life, ensuring you can fulfill work, school, and basic needs. However, purchasing a vehicle can be costly, and traditional lenders often demand down payments and impose strict requirements for bad credit auto financing. The listed lending networks offer an opportunity for individuals with less-than-perfect credit to secure bad credit car loans, potentially with zero down payment. This allows you to obtain reliable transportation without sacrificing funds meant for other essential expenses.

(5) Car Dealers That Accept Bad Credit Car Loans With Zero Down

There are hundreds of car dealers across the United States who are willing to work with individuals with bad credit. We have reviewed three direct lenders and three lending networks that provide various loan options. This demonstrates that having bad credit does not necessarily hinder your ability to purchase a new or used car.

- myAutoloan.com

- Carvana

- CarMax

- DriveTime

1. myAutoloan.com

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2003 | 2 minutes | 7.5/10 |

- Provides loans for new vehicle purchases, used vehicle purchases, and refinancing existing loans

- Accesses a network of lenders across the nation

- Accepts borrowers with bad credit

- Offers the possibility of receiving up to 4 loan offers within minutes

- Provides the convenience of receiving an online loan certificate or check within 24 hours.

2. Carvana

Carvana revolutionized the car-buying process by offering no-contact sales, allowing customers to choose a vehicle, arrange financing online, and have the car delivered to their doorstep. They offer their financing options for individuals with bad credit but also give them the flexibility to use external lenders if desired. The loan process can be completed in as little as 10 minutes, and customers can schedule the delivery of their vehicle.

3. CarMax

CarMax, a widely recognized brand with nearly 200 dealerships across the country, regularly accepts loan applications from individuals with poor or limited credit. Customers have the option to finance their car through CarMax or opt for an external lender. Regardless of the chosen financing method, CarMax offers the ability to purchase a car or refinance an existing vehicle, catering to customers with various credit profiles.

4. DriveTime

DriveTime, with over 130 dealerships across the country, specializes in offering loans to individuals with poor credit scores. With a history of providing 4 million vehicle loans, DriveTime has developed an efficient approval process for most applicants. The loan offer from DriveTime will outline an initial down payment and affordable monthly payment installments tailored to fit your budget based on the price of the car.

What information is required to fill out an Auto Loan application?

When applying for a car loan through a dealer network, you will be asked to provide personal information such as your name, address, Social Security number, employment and income details, existing debts, and other financial information.

During the prequalification process, a soft inquiry is conducted on your credit history to assess your eligibility.

If you prequalify, the dealer will proceed with a hard inquiry and gather additional information before finalizing the loan offer.

In addition to your bad credit score, lenders typically consider factors such as past defaults, write-offs, collections, repossessions, and bankruptcies.

However, these negative factors may not necessarily disqualify you, especially for secured loans like auto financing.

It is advisable to check your credit score before applying for a loan, especially when it comes to auto loans.

Scoring systems specific to the automotive industry place particular emphasis on data that can influence a dealer’s loan decisions.

This includes information related to your credit history and financial standing that may impact your ability to secure favorable loan terms from the dealer.

Auto-scoring systems focus on data affecting loan decisions, such as:

- Car-related bankruptcies

- A thin or short credit history

- Late automobile payments

- Repossession and collection activity related to car loans

- Lack of different credit types used

Tips to Improve Auto Loan Terms

To improve the terms of your subprime car loan, consider getting a cosigner with excellent credit who will be responsible for missed payments based on their credit score.

To improve your vehicle loan terms, it’s beneficial to provide equity through a down payment or trade-in. Having equity motivates timely payments and reduces lender risk.

To secure better loan terms, work on improving your credit score by paying bills on time, maintaining a low debt-to-income ratio, and addressing any credit report issues independently or with professional assistance.

Zero Down Bad Credit Car Dealers Near Me

In the digital era, searching for specific financial services like bad credit car loans with zero down or personal payday loans has become much easier and faster. When searching for financial services online, it is crucial to exercise caution and be mindful of scams or fraudulent activities. Always verify the credibility and legitimacy of the lenders or service providers before providing any personal or financial information.

-

Bad credit car dealers Denver

Here at Larry H. Miller Chrysler Dodge Jeep Ram 104th, help you with bad credit car loans with zero down.

- Contact our Sales Department at720-807-2922

The Denver Jeep dealership has established a dedicated department to assist individuals in need by providing reliable vehicles and aiding in credit rebuilding. Their trained staff are available to offer support and guidance. The dealership is conveniently located a few miles west of I-25 on 104th Avenue at 1800 W. 104th Ave, serving the Denver Metro area.

-

Bad credit car dealers Philadelphia

- Contact the Sales Department at 215-309-8746

- barberasautoland.com/credit-approval-in-philadelphia

Barbera Autoland offers a wide range of options for car shoppers, regardless of their credit history. Whether you have good credit, bad credit, or no credit at all, they provide choices that suit every lifestyle and budget. Their inventory includes new Jeep SUVs, RAM trucks, Dodge sports cars, and Chrysler minivans, as well as a great selection of used cars, trucks, and SUVs. They also offer financing options, special offers, and lease specials to make the car-buying process easier.

-

Bad credit car dealers New Jersey

Pine Belt Cars of New Jersey is committed to assisting residents of the Lakewood area and beyond by offering guaranteed bad credit car loans with zero down.

- 1088 Rt 88/Ocean Ave • Lakewood, NJ 08701 US

pinebeltcars.com/finance/guaranteed-credit-approval/

- Main:888-374-6323

Sales:888-374-6323

Service:888-374-6323

They understand that individuals with bad credit often face challenges when applying for vehicle financing. They believe that settling for a vehicle solely based on credit status instead of getting the car that truly meets your needs can lead to disappointment. Additionally, they recognize the stress that can arise when purchasing a car and struggling to afford the payments.

-

Bad credit car dealers CT

If you have been trying to rebuild your credit but don’t know where to start, Stephen Automall Centre is happy to offer drivers a second chance at bad credit car loans with zero down of all the chaos.

- 1097 Farmington Ave, Bristol, CT 06010

-

Phone: (860)584-7333

- ctautomall.com/bad-credit-financing

If you have intense questions surrounding your credit report or bad credit financing, they will happily answer them all. They can also help you navigate their secure online credit application.

-

Bad credit car Dealers NY, USA

Plaza Auto Mall is dedicated to serving car shoppers in the Manhattan and Queens, New York areas with low credit. They offer a wide range of used vehicles from top brands like Toyota, Honda, Acura, Kia, and Hyundai. With in-house finance departments at their Brooklyn, NY locations, Plaza Auto Mall is committed to helping customers secure sub-prime bad credit car loans with zero down.

-

Bad credit car dealers Pittsburgh

When seeking a bad credit car loan in the Pittsburgh area, Century 3 Chevrolet offers an easier process due to their partnerships with over 20 bad credit lenders, enabling them to negotiate on your behalf. To begin, fill out their finance application and reach out to their auto finance department. With over 30 years of experience, Century 3 Chevrolet specializes in bad credit car loans bad credit car loans with zero down in Pittsburgh, South Hills, and Monroeville. Follow these tips for a seamless transaction.

2430 Lebanon Church Rd

West Mifflin, PA 15122

-

Bad credit car dealers kansas city

McCarthy Lee’s Summit Collision Center

945 S.E. Oldham Pwky.

-

Bad credit car dealers Grand Rapids

FAQs: Bad credit car loans with zero down

Can I get a bad credit car loans with zero down through a bank?

Most banks and credit unions indeed have strict requirements when it comes to granting auto loans to individuals with bad credit. This is because these financial institutions, particularly publicly traded ones, prioritize profitability and risk management. Subprime auto loans can pose potential financial risks if not repaid, impacting the institution’s profits and potentially endangering executive positions.

In contrast, auto lending networks provide advantages by allowing applicants to submit loan requests to multiple lenders simultaneously. This increases the likelihood of approval and creates a competitive environment where lenders vie for the borrower’s business. As a result, borrowers often receive more competitive loan offers through auto lending networks.

Can I get an auto loan online?

Online loans have gained popularity due to their ease of use, prompting more consumers to choose them over traditional banks and credit unions. The application process typically involves providing basic personal information like name, address, phone number, Social Security number, and income. Importantly, this initial step does not result in a credit inquiry or harm your credit score.

Once you submit your loan request through an online lending network, it is forwarded to partner lenders, which can include private lenders or car dealerships connected to lenders offering bad-credit auto financing. If a dealer or lender is interested in working with you, they will conduct a full credit check using one of the major credit bureaus. Based on your credit history, income, and other relevant information, they will strive to find suitable bad credit financing options for you.

The interest rate, monthly payment, and loan term will vary depending on your creditworthiness and the criteria of the multiple lenders who receive your loan request.

Do car dealerships approve bad credit car loans with zero down?

Bad-credit car dealerships specialize in selling vehicles to consumers with below-average credit. These dealerships offer bad-credit auto financing, using the vehicles as collateral. If a buyer defaults on payments, the dealership can repossess the car and sell it to someone else.

This model reduces the risk for lenders and allows them to provide financing to individuals who may not qualify for traditional loans.

Auto Credit Express, LendingTree, Car.Loan.com, and MyAutoloan.com are platforms that connect borrowers with a network of lenders who specialize in bad credit auto financing, ensuring a quick and efficient process.