What is MOIC Finance and MOIC Calculation: Best 3 Examples

Understanding MOIC Finance and its various performance metrics is crucial for evaluating investment success. One such metric is MOIC (Multiple on Invested Capital). In this post, we will delve into the concept of MOIC, its significance, and how it is used in financial analysis.

What is Moic in Finance

MOIC is a crucial metric in finance that measures the return on investment relative to the initial capital invested. It helps investors evaluate the success and profitability of their investments in various sectors, including private equity, real estate, and venture capital. By understanding and utilizing MOIC, investors can make informed decisions and assess the performance of their investment portfolios.

What is MOIC?

MOIC, or Multiple on Invested Capital, is a financial metric that measures the return on investment (ROI) relative to the initial capital invested. It quantifies how much an investment has grown or appreciated based on the ratio of the final investment value to the initial investment amount.

Calculation of MOIC Finance:

MOIC is calculated by dividing the total investment value, including capital appreciation and any cash distributions, by the initial investment amount. The resulting multiple represents how many times the initial investment has grown.

MOIC = Total Investment Value / Initial Investment Amount

Significance of MOIC Finance:

MOIC provides a clear measure of the return generated by an investment. It allows investors to assess the profitability and success of their investments by quantifying the growth or appreciation of their capital. A higher MOIC indicates a more favorable return, while a lower MOIC suggests a suboptimal investment outcome.

Use Cases of MOIC Finance:

- Private Equity: MOIC is widely used in private equity to evaluate the performance of investments in private companies. It helps investors assess the success of their investments and compare different investment opportunities.

- Real Estate: In the real estate industry, MOIC is utilized to assess the financial performance of property investments. It helps investors determine the profitability and efficiency of their real estate ventures.

- Venture Capital: Venture capitalists often rely on MOIC to measure the success of their investments in startups and early-stage companies. It provides insights into the growth and value-creation potential of these investments.

Key Takeaways: Moic Finance

- MOIC (Multiple on Invested Capital) is a financial metric used to assess investment profitability.

- It compares total cash inflows to the initial capital invested.

- It is commonly employed in private equity, venture capital, and investment analysis.

- MOIC helps compare investment performance, evaluate capital allocation decisions, and inform investment choices.

- It does not explicitly account for the timing of cash inflows, which can be a limitation.

- Investments with different time horizons or cash flow patterns may require additional analysis.

- MOIC should be used alongside other financial metrics, risk assessments, and qualitative factors for a comprehensive understanding of investment profitability.

Moic calculation and Moic Formula

MOIC finance is a key metric used to assess the performance and profitability of investments.

The calculation of MOIC finance (Multiple on Invested Capital) involves dividing the total investment value by the initial investment amount. Here is the formula for calculating MOIC:

MOIC = Total Investment Value / Initial Investment Amount

To calculate MOIC, follow these steps:

- Determine the Total Investment Value: This includes the sum of all cash inflows and outflows related to the investment. It typically consists of the initial investment amount, capital appreciation (increase in investment value), and any cash distributions received (such as dividends or profits).

- Identify the Initial Investment Amount: This refers to the initial capital invested in the asset or project.

- Divide the Total Investment Value by the Initial Investment Amount: Divide the total investment value by the initial investment amount to calculate the MOIC. The resulting multiple represents how many times the initial investment has grown.

For example, if the total investment value is $10,000,000 and the initial investment amount is $1,000,000, the MOIC would be:

MOIC = $10,000,000 / $1,000,000

MOIC = 10x

In this example, the MOIC is 10x, indicating that the investment has generated a return of 10 times the initial investment amount.

Moic calculator:

A MOIC calculator is a tool or formula used to calculate MOIC finance by dividing the total investment value by the initial investment amount, providing a measure of investment return.

How to revolutionize your real estate portfolio with the power of MOIC Finance.

By incorporating MOIC finance into your real estate portfolio, you can potentially revolutionize your investment approach. With its clear and objective measure of ROI, MOIC finance empowers informed decision-making and return optimization. It aids in risk identification, enables efficient capital allocation, and helps seize opportunities. Though challenges exist, the benefits of using MOIC finances outweigh the drawbacks. By embracing MOIC finance, you can elevate your portfolio and work towards achieving your investment objectives.

Advantages of Using MOIC Finance for Real Estate Investments

MOIC finance offers investors a transparent and unbiased way to gauge investment returns, enabling effective comparisons and informed decision-making. By considering the time value of money, including the timing and size of cash flows, it addresses the unique challenges posed by irregular and unpredictable cash flows in real estate investments.

MOIC finance not only helps in risk identification but also assists in risk mitigation for investors. Through the calculation of the MOIC ratio, investors can gauge the probability of attaining desired returns and adapt their strategies accordingly, reducing the potential for losses while optimizing profit potential. Additionally, MOIC finance establishes a framework for evaluating real estate investment performance over time, enabling investors to monitor the MOIC ratio and make necessary adjustments along the investment journey.

How MOIC Finance Works in Real Estate Portfolio Management

Embracing MOIC finances in real estate portfolio management can be transformative. This metric empowers investors to assess property performance and the portfolio as a whole, identify underperforming assets, and make informed decisions regarding holding, selling, or reinvesting. It also facilitates efficient capital allocation by prioritizing properties with higher MOIC ratios.

Moreover, MOIC finance serves as a benchmark for evaluating the performance of diverse real estate investments. By utilizing the MOIC ratio, investors can assess the relative appeal of different opportunities and allocate capital strategically, fostering portfolio diversification and minimizing risk. Ultimately, integrating MOIC finances into real estate portfolio management facilitates optimized returns and the attainment of investment objectives.

MOIC Finance Strategies for Real Estate Investment Optimization

To effectively incorporate MOIC finances in your real estate investments, develop a comprehensive strategy. Identify investment goals and risk tolerance, determine desired MOIC ratios, and analyze potential investments through due diligence on cash flows, market dynamics, and growth potential.

After selecting suitable investments, monitor their performance regularly by tracking cash flows and assessing value-creation drivers. Active management and data-driven decisions enhance the chances of achieving the desired MOIC ratio. Regularly review and adjust your portfolio to maintain alignment with your investment strategy.

Challenges and Risks of Using MOIC Finance in Real Estate

While MOIC finance offers advantages, challenges exist in accurately forecasting cash flows and estimating returns in real estate investments due to uncertainty and rapidly changing market conditions. Data reliability also affects the accuracy of MOIC ratio calculations.

One risk of relying solely on MOIC finance is neglecting other crucial factors for investment decisions, such as market conditions, location, and property-specific attributes. Additionally, MOIC finances may not consider taxes, financing costs, and expenses, which should be included to evaluate investment profitability properly.

The Future of MOIC Finance in the Real Estate Industry

As the real estate industry advances, MOIC finance is poised to become increasingly vital. Investors are embracing data-driven strategies, and MOIC finance offers a valuable tool. Technological advancements and access to big data simplify MOIC ratio calculations, empowering investors to optimize their real estate portfolios through informed decision-making.

The rise of alternative real estate investments like crowdfunding and REITs creates a need for MOIC finance. These investments have intricate capital structures and cash flow patterns, making profitability assessments challenging. MOIC finance offers a standardized metric to evaluate and compare them with traditional real estate assets.

FAQs: MOIC Finance

What is Moic?

MOIC (Multiple on Invested Capital) is a measurement utilized in private markets to assess the value or performance of an investment based on its initial cost. It quantifies the return generated by an investment relative to the amount of capital initially invested.

In MOIC finance, achieving a high MOIC is often a primary objective for investors to maximize their returns and generate significant value from their financial ventures.

What is a good Moic?

Typically, a low MOIC, which is usually below 2x, indicates a suboptimal investment for a private equity fund. On the other hand, a MOIC of 2.0x or higher is generally considered a favorable benchmark for investment performance in private equity. This level signifies that the initial investment has doubled. A high MOIC is typically defined as anything greater than 3.0x or higher.

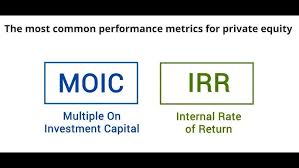

What is Moic vs IRR?

MOIC provides information on the absolute growth of an investment’s value, whereas the Internal Rate of Return (IRR) measures the annualized returns generated by the investment. For instance, if you invest $1,000,000 and receive $10,000,000 in returns over 10 years, your MOIC would be 10x. Similarly, if you achieve the same return of $10,000,000 but in a shorter time frame of 3 years, your MOIC would still be 10x.

MOIC finance vs IRR

MOIC measures the ratio of total cash inflows to the initial investment, focusing on profitability and return on investment. It doesn’t consider non-cash returns or the time value of money. On the other hand, IRR represents the discount rate that equates the present value of cash inflows to the initial investment, incorporating the time value of money. It considers both cash inflows and outflows throughout the investment’s life and can be used to assess risk and volatility. While MOIC is more focused on profitability, IRR is used to evaluate the rate of return and overall project profitability. Both metrics are commonly used in capital budgeting, project evaluation, and investment decision-making.

What is Moic in real estate?

In real estate, MOIC stands for “Multiple on Invested Capital.” It is a metric used to assess the performance or value of an investment property relative to the initial capital invested. MOIC in real estate calculates the ratio of the property’s final value or net cash flow to the initial investment amount. It helps investors understand how much their capital has grown or how efficiently it has been utilized in a real estate investment. A higher MOIC indicates a more favorable return on investment.

What is Moic in private equity?

In private equity, MOIC stands for “Multiple on Invested Capital.” It is a metric used to evaluate the performance of an investment relative to the initial capital invested. MOIC calculates the ratio of the investment’s total cash flows, including distributions and capital appreciation, to the initial investment amount. It provides a measure of the return generated by the investment, indicating how much the investment has grown over time. A higher MOIC typically indicates a more successful and profitable investment in private equity.

Recap: MOIC Finance

MOIC Definition: MOIC stands for Multiple on Invested Capital and is a metric used to express the return on investment as a multiple of the initial amount of capital invested. It is commonly used to evaluate the performance of private investments.

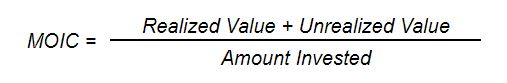

MOIC Formula:

MOIC Example:

In the given scenario, the investor purchased a building for $10 million, received $2 million in distributions, and the building’s value appreciated to $13 million. The total realized value is $2 million, the total unrealized value is $13 million, and the total cost is $10 million. Therefore, the MOIC would be calculated as $15 million (total realized and unrealized value) divided by $10 million (total cost), resulting in an MOIC of 1.5x.

Shortfalls of MOIC

In the context of Moic finance, while MOIC is a valuable metric for assessing private equity investments, it does have certain limitations that should be considered.

- MOIC Does Not Consider Time

- MOIC Does Not Consider Time Value of Money

- MOIC May Not Represent Investor Returns

How to calculate MOIC.

| Value of realized proceeds | : $0.4 billion |

| Unrealized value of public securities | : $3.0 billion |

| Unrealized value of private securities | : $7.5 billion |

| Initial investment | : $4.7 billion |

See More:

- Digital Transformation in Business: Trend| Future| Benefits

- What is Business Process Transformation?

- Business Planning Process and Types of Business Strategy

- Best Financial Digital Transformation Services: Trend | Future

- What is a consumer finance account and Its Types?

-

Is Finance a Hard Major: 5 BEST POINTERS