Best Financial Digital Transformation Services: Trend | Future

Financial digital transformation services involve leveraging technology to optimize functions like accounting, creating efficient operating systems, and improving customer service. In today’s digital age, customers expect convenience and options across multiple channels, and finance should not lag. Companies like JPMorgan Chase have recognized this and invested in technology to enhance their services. Finance companies should identify areas where technology can improve the customer experience and allocate resources accordingly.

What is Digital Transformation in Financial Services

Financial digital transformation services refer to the process of adopting and integrating digital technologies and strategies to fundamentally change how financial institutions operate, deliver services, and interact with customers. It involves leveraging technologies such as cloud computing, artificial intelligence, data analytics, mobile applications, and blockchain to streamline processes, enhance efficiency, improve customer experiences, and drive innovation. Digital transformation entails rethinking traditional business models and embracing digital solutions to meet the evolving demands of the industry and stay competitive in the digital age.

Why financial digital transformation

Digitalization allows financial institutions to offer innovative services and products that cater to the evolving needs of customers. This includes providing convenient access to accounts, facilitating efficient budget management, and offering personalized investment solutions. Ultimately, digitalization helps financial businesses optimize their costs while simultaneously delivering an enhanced customer experience.

FinTech is revolutionizing the financial services industry by enabling the integration of digitally-enabled products and services. This has led to the emergence of a new ecosystem of apps, websites, and automated services, greatly enhancing the customer experience.

Some of the significant areas where financial digital transformation is creating positive digital disruption include:

- Payment software and systems: PayPal, Wise, and Venom

- Crowdfunding platforms: GoFundMe, Patreon

- Price comparison tools: Moneyfacts, Trivago, and Cheapshark

- Investment applications: Etrade, Interactive Brokers

- Industry-specific CRM tools

- Compliance and regulation technology (RegTech): Suade, Alyn

- Security improvements: Biometric data for the credit underwriting process

Financial Digital Transformation Services vs The Future of Technology

The benefits of digital transformation in the financial services industry are evident. It enables financial institutions to create excellent employee experiences, enhance security measures, and expand their customer base.

While many institutions have already embarked on their digital transformation journeys, there is still more work to be done. To remain competitive, financial service companies must develop comprehensive digital transformation strategies that encompass all aspects of the customer experience.

It is crucial to keep pace with the evolving landscape and adapt services to future technology trends. By leveraging technologies like cloud computing, artificial intelligence, and blockchain, financial organizations can achieve cost reductions, improved efficiency, and enhanced customer experiences.

Digital transformation in banking and financial services

Financial digital transformation in banking refers to the comprehensive adoption of digital technologies and strategies to revolutionize the way these institutions operate and cater to their customers.

Financial services digital transformation involves leveraging advancements like mobile banking, online platforms, data analytics, artificial intelligence, blockchain, and cloud computing to enhance operational efficiency, improve customer experiences, and drive innovation.

Through digital transformation, banks and financial institutions can automate processes, offer personalized services, enable seamless transactions, enhance security measures, and gain valuable insights from data analytics.

This transformation enables them to stay competitive in a rapidly evolving digital landscape and meet the changing expectations and demands of customers in the digital age.

What a successful Financial digital transformation service should look like?

- Portable digital answers for convenience

- Exceptional customer experience, adaptable interface, and simple navigation

- Varied layers of security measures

- Results-oriented, up-to-date digital banking options aligned with market needs

- Effortless incorporation with outside systems

- Personalized solutions tailored to each customer’s needs

- Portable digital answers for convenience

To meet evolving customer expectations, financial institutions are required to provide a seamless, personalized, and secure digital experience. This entails offering integrated mobile services for various transactions, personalized communications and offers, and responsive customer support. By adopting a customer-centric approach and leveraging data analytics, banks can better understand customer needs and behaviors, enabling them to deliver exceptional experiences that align with individual preferences and enhance overall satisfaction.

- Exceptional customer experience, adaptable interface, and simple navigation

- Varied layers of security measures

Banks and financial institutions must prioritize the implementation of robust security measures to protect sensitive customer data from unauthorized access and fraudulent activities. Failure to provide adequate security can result in severe consequences such as reputational damage, financial loss, and legal implications. To mitigate these risks, financial service providers should focus on implementing multi-level security protocols in their digital applications. This includes encryption, authentication mechanisms, secure data storage, regular security audits, and staying updated on the latest security best practices and regulations.

To prevent this, BFSPs must provide digital security that encompasses:

- Multi-tiered security measures: Encryption, firewalls, intrusion detection, and access control mechanisms are part of the security protocols.

- Access control tools like passwords, two-factor authentication, and biometrics limit data access to authorized users.

- Agile digital apps demand frequent updates for security patches and staff training on security protocols.

What are the three key areas of financial digital transformation services?

Digital transformation in financial services is indeed aimed at making banking faster and more efficient, but implementation can be challenging due to several factors:

- Upskilling the workforce: A significant portion of the workforce may lack the necessary digital skills. Empowering employees to seek solutions, automate tasks, and engage in creative work requires upskilling initiatives to bridge the digital skills gap.

- Security and compliance: Financial institutions handle large volumes of sensitive data, making security and compliance essential. Transitioning to new technologies while ensuring compliance with regulations poses challenges that require robust security measures and risk management practices.

- Digital and contactless payments: With the rise of e-commerce and direct transactions, traditional banks face competition from tech-savvy retailers. While traditional banks still hold an advantage in terms of trust, they need to focus on providing secure environments for digital and contactless payments to remain relevant.

Consider building and executing strategies in financial digital transformation

When developing and implementing digital strategies in financial services, it is important to align them with your core business objectives. Consider the following factors:

- Clearly define your objectives: Clearly articulate the specific goals and outcomes you aim to achieve through digital transformation, such as improving operational efficiency, enhancing customer experience, or expanding market reach.

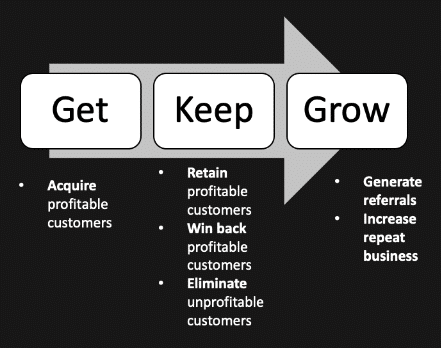

- Understand customer needs: Gain a deep understanding of your customers’ preferences, behaviors, and pain points. Use this insight to develop digital solutions that address their needs and deliver a seamless and personalized experience.

- Invest in talent and upskilling: Build a skilled and digitally proficient workforce by investing in talent acquisition and upskilling programs. Ensure your employees have the necessary digital skills to drive innovation and effectively utilize digital tools and technologies.

- Prioritize security and compliance: Implement robust security measures to protect sensitive customer data and ensure compliance with industry regulations. Develop a comprehensive cybersecurity strategy that addresses potential risks and safeguards against cyber threats.

- Foster a culture of innovation: Encourage a culture of continuous innovation and experimentation within your organization. Embrace emerging technologies and encourage employees to think creatively, explore new ideas, and implement innovative solutions.

- Collaborate with technology partners: Forge strategic partnerships with technology providers and FinTech companies to leverage their expertise and access cutting-edge solutions. Collaborative efforts can accelerate digital transformation and open new avenues for growth.

1. Collect insights and analyze data

Leverage the vast amount of structured and unstructured data generated from customer interactions on your website, social media platforms, and customer care team, supplemented with additional data sources for comprehensive insights.

- Competitive insights and benchmarking

- Customer sentiment

- Media monitoring and analytics

- Critical industry and market trends

- Product insights

Consider allocating resources to strengthen your social media strategy, focusing on engaging with and responding to customer interactions on these preferred channels. Use data-driven insights to inform decisions and improve social media marketing efforts in the financial services sector.

2. Leverage the power of social media

Meeting customers on digital channels, including social media, is essential for building strong relationships and delivering consistent customer experiences. Today, customer experience extends beyond excellent service to accessing bank accounts through multiple channels and receiving instant responses. Utilizing social media can be done through posting and interacting on corporate brand handles, and automating social publishing and engagement ensures engagement on preferred channels. Capitalizing on social media in these ways enables financial institutions to enhance customer engagement and satisfaction.

3. Select the right technology stack for a highly regulated industry

Implementing a successful digital strategy in financial digital transformation services can be challenging due to the complexity of regulatory compliance, data management, and the multitude of available tools. However, selecting the appropriate solution can significantly impact the outcome and effectiveness of the digital strategy execution in the industry.

One common mistake made by companies is choosing separate solutions for each specific need, resulting in a fragmented approach.

- Social media managers utilize a dedicated tool for posting content and engaging on branded social media handles.

- The data and analytics team employs a separate tool to collect metrics and analyze data, enabling them to view dashboards and gain insights.

- The customer care team utilizes a distinct tool for communicating with customers and resolving their issues effectively.

An excess of tools creates departmental silos, resulting in confusion, misalignment, and errors that could result in expensive regulatory penalties.

Digital transformation in financial services – Digital transformation financial services – Digital transformation in banking and financial services – Financial services digital transformation, Financial digital transformation