What is AOP Finance Meaning: Acronym Business| Benefits

“AOP finance” typically stands for “Annual Operating Plan finance.” It refers to the financial planning and budgeting process that a company or organization undertakes on an annual basis. AOP finance involves setting financial goals, forecasting revenues and expenses, allocating resources, and creating a comprehensive plan for the upcoming fiscal year. It’s a strategic process that helps businesses outline their financial objectives and allocate resources efficiently to achieve those goals.

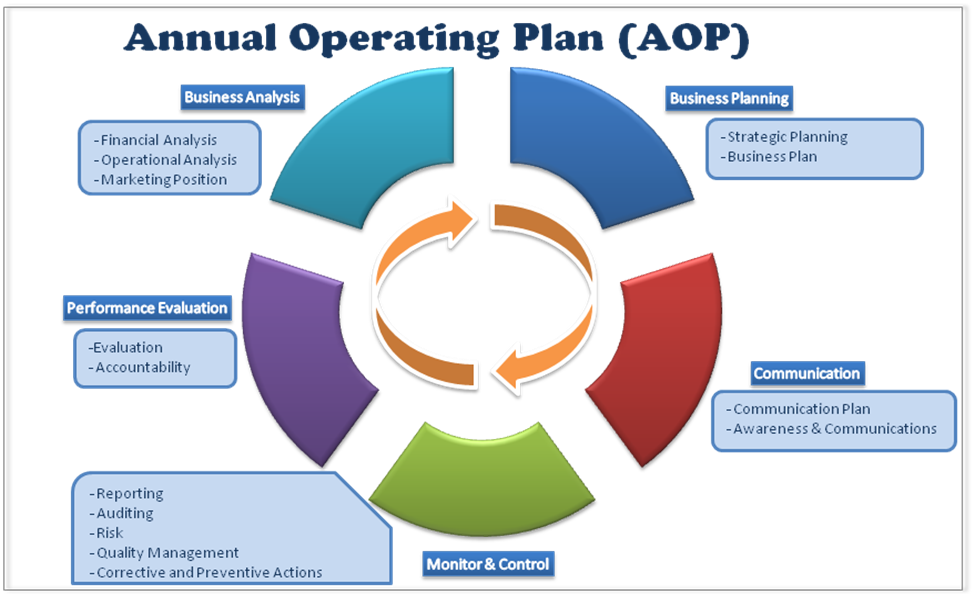

The AOP (Annual Operating Plan) process is crucial for aligning organizational efforts and making informed decisions. It involves determining goals, priorities, and resource allocation. Key components include setting strategic objectives and creating action plans to drive growth. A well-executed AOP helps guide and navigate the organization toward its desired outcomes.

What is AOP in finance?

In finance, AOP stands for “Annual Operating Plan.” It is a detailed financial plan that outlines an organization’s projected revenues, expenses, and anticipated performance for the upcoming fiscal year. The AOP typically includes revenue targets, cost estimates, capital expenditure plans, and other financial metrics. It serves as a roadmap for the organization’s financial activities and helps guide decision-making and resource allocation throughout the year. The AOP is usually created based on historical data, market trends, and the strategic objectives of the organization. It provides a framework for evaluating the financial performance and progress of the organization against its planned targets.

AOP Meaning in Finance

In finance, AOP can have different meanings depending on the context. Here are a few possible interpretations:

- Annual Operating Plan: This refers to a comprehensive financial plan that outlines an organization’s projected revenues, expenses, and performance targets for a specific fiscal year. It serves as a blueprint for financial decision-making and resource allocation.

- Adjusted Operating Profit: AOP can also represent Adjusted Operating Profit, which is a measure of a company’s operating profit that is adjusted to exclude certain one-time or non-recurring items. It provides a clearer picture of the company’s ongoing operational performance.

- Allocation of Purchase: AOP can also refer to Allocation of Purchase, which is a method used in accounting and finance to allocate the cost of an acquired company or asset to various components, such as tangible assets, intangible assets, and liabilities.

The Benefits of AOP Finance

AOP Finance, or Adjusted Operating Profit in finance, refers to a measure of a company’s operating profit that is adjusted to exclude certain one-time or non-recurring items. While AOP Finance is not typically used as a standalone term, let’s discuss the potential benefits of utilizing adjusted operating profit in financial analysis and decision-making:

- Clearer Picture of Operating Performance:

By eliminating one-time or non-recurring items from operating profit, AOP Finance provides a clearer and more accurate representation of a company’s ongoing operational performance. It helps to distinguish between temporary fluctuations and the underlying profitability of the business.

- Enhanced Comparability:

AOP Finance allows for improved comparability among different periods or companies. By removing exceptional items, such as gains or losses from asset sales, restructuring costs, or extraordinary expenses, AOP Finance helps to normalize financial results, enabling more meaningful comparisons.

- Improved Decision-Making:

AOP Finance aids in making more informed financial decisions. By focusing on the core operational performance of a company, decision-makers can better assess the effectiveness of strategies, evaluate the profitability of business units or segments, and allocate resources more effectively.

- Investor and Stakeholder Understanding:

AOP Finance provides investors and stakeholders with a more accurate representation of a company’s ongoing profitability. By excluding one-time or non-recurring items, AOP Finance helps in presenting a more stable and sustainable financial performance, which can enhance transparency and facilitate better investor understanding.

- Valuation and Financial Analysis:

AOP Finance can be valuable in valuation exercises and financial analysis. Since it reflects the recurring profitability of a company, adjusted operating profit is often used as a basis for valuation multiples, such as price-to-earnings (P/E) ratios or enterprise value-to-EBITDA (EV/EBITDA) multiples, allowing for more accurate and meaningful valuation assessments.

- Risk Assessment:

AOP Finance can assist in assessing the financial risk associated with a company. By focusing on the core operating profitability, it helps to identify potential risks that could impact the ongoing financial performance of the organization, providing a more comprehensive risk assessment framework.

- Internal Performance Evaluation:

AOP Finance can be used as a key metric for internal performance evaluation. By excluding exceptional items, AOP Finance helps in evaluating the effectiveness of cost management, operational efficiency, and overall financial performance, providing insights into areas for improvement and driving performance-based decision-making.

AOPs provide a systematic approach to financial planning for the upcoming year. They allow organizations to set realistic financial goals, estimate revenues, forecast expenses, and allocate resources accordingly. This helps in ensuring financial stability and sustainability.

- Infuse departmental plans and strategies with a stronger reliance on data-driven insights.

- Synchronize cross-functional departments with overarching business objectives.

- Illuminate potential requirements for re-evaluating fundraising or expenditure.

- Provide departments with a benchmark for monitoring performance and objectives

Creating an AOP (Annual Operating Plan) financial plan involves outlining your financial goals, forecasting revenues and expenses, and determining strategies to achieve those goals. Here are some steps to help you create an AOP financial plan:

- Define Your Financial Goals:

Start by clearly defining your financial objectives for the upcoming year. These goals could include revenue targets, profit margins, expense reduction, market expansion, or any other financial milestones you want to achieve.

A SMART goal example for increasing revenue by 10%: increase sales by 5% in Q1, 3% in Q2, and 2% in Q3 and Q4. This approach breaks down the objective into manageable goals. Learn how Prefect improved strategic planning by 3x using this framework: [link].

- Review historical data:

Analyze your historical financial data, such as the previous year’s revenues, expenses, and key performance indicators (KPIs). This will provide insights into your business’s financial trends and help you set realistic targets for the upcoming year. When aiming to increase customer retention rates, a relevant KPI could be the percentage of customers making repeat purchases within a defined timeframe.

- Forecast Revenues:

Estimate your expected revenues for the year. Consider factors such as sales projections, market trends, customer demand, and pricing strategies. Break down your revenue forecasts by product or service categories, customer segments, or geographical regions, as applicable. To ensure accurate forecasting and target achievement, it’s crucial to set a realistic budget by avoiding overestimating revenue and underestimating expenses.

- Plan Expenses:

Identify and forecast your anticipated expenses for the year. Categorize expenses into fixed (e.g., rent, salaries) and variable (e.g., marketing, supplies) costs. Review historical expense data, consider any planned changes or investments, and account for inflation or cost fluctuations.

- Cash Flow Management:

Assess your projected cash inflows and outflows throughout the year. Aim to maintain a healthy cash flow by ensuring that your cash inflows (revenues, investments, and loans) are sufficient to cover your cash outflows (expenses, loan repayments, and purchases).

- Identify Risks and Mitigation Strategies:

Identify potential risks or challenges that could impact your financial plan. These could include changes in the market, the regulatory environment, or unexpected events. Develop strategies to mitigate these risks and ensure business continuity.

After identifying objectives, select purpose-driven KPIs aligned with available data within your organization, such as revenue growth, customer retention rates, and employee engagement scores, to measure progress toward your goals.

- Defining Roles and Responsibilities

To ensure clarity and accountability, identify project or initiative owners and outline their key tasks and deliverables. Clearly defining roles and responsibilities helps align individual contributions with larger objectives and promotes effective teamwork toward goal achievement.

- Creating a Timeline for Execution

Once your objectives, KPIs, budget, and roles are defined, establish a timeline with milestones and deadlines for each department or function. Include contingency plans for unexpected roadblocks. A clear timeline ensures organizational alignment and facilitates the smooth execution of your annual operating plan.

Make an Annual Operating Plan (AOP Finance) for your business in three (3) steps.

The annual operating plan offers a clear pathway to achieve financial objectives and expand business operations, structured within three essential steps.

1. The revenue projection for next year

- Assess the financial performance of the current year.

- Determine the revenue goal or target for the upcoming year.

- Brainstorm ideas with the team to bridge the gap between the current year’s results and next year’s goals.

- Collaborate with sales heads to obtain detailed sales projections by region, customer, product, and segment.

- Take an active role in analyzing and breaking down the sales projections to create a clear revenue plan for the year.

- Allocate production expenses to the production department for the current year.

- Coordinate with each department to discuss the necessary changes they will make to meet the new revenue targets.

- Collaborate with departments to identify potential new projects or initiatives that can contribute to revenue growth.

- Assess infrastructure needs and determine any new installations required to support the revenue goals.

- Discuss hiring requirements with each department to ensure adequate staffing for achieving the revenue targets.

- Request each department to inform management of their capital expenditure (CAPEX) and operating expenditure (OPEX) requirements.

3. Arriving at a realistic plan

- Generate a preliminary Profit and Loss (P&L) account, Balance Sheet, and Cash Flow Statement based on the top-down revenue projection and bottom-up expense projections.

- Engage with the team to discuss and analyze the projections, considering their expertise and insights.

- Collaboratively refine the plan to ensure a realistic and achievable financial outlook.

- Review the targets and financial plan with each department, emphasizing their roles and responsibilities in achieving the goals.

- Communicate the finalized targets and financial plan to all departments, ensuring clarity and alignment across the organization.

Business Planning and AOP Finance

Business planning, often done annually, involves creating a volume, cost, and profit plan for the upcoming year. This process, also known as the annual budgeting process, is crucial for companies. Long-term forecasts are inherently more prone to errors due to dynamic variables and uncertainty about future conditions. Therefore, conducting a sensitivity analysis helps assess the robustness of the forecast. The marketing plan is an integral part of the business plan, outlining volume forecasts and the required spending levels to generate and maintain expected product demand. This comprehensive approach helps organizations align their strategies, resources, and financial expectations.

The structure commonly used for a business plan or an AOP finance often adheres to the following framework:

- Capacity and bottleneck analysis

- Achieving organizational consensus

- Adjustments to spending and volume forecasts

- Gaining management buy-in

- Consideration of internal factors

- Creation of a comprehensive sales and marketing plan

- Monthly calendar-based forecasting

- Strategic analysis of external factors

What are the key steps in the AOP process?

In AOP finance, the Annual Operating Plan (AOP) process in consumer goods companies generally comprises essential steps, varying based on company size, structure, and industry specifics.

The AOP process for CPG companies typically involves the following key steps:

- Conduct a SWOT analysis to assess the company’s current situation and performance, identifying strengths, weaknesses, opportunities, and threats.

- Define strategic objectives and initiatives that align with the company’s vision, mission, and values for the year.

- Develop a sales and marketing plan, including target markets, segments, customers, channels, products, prices, promotions, and distribution strategies.

- Develop an operations plan, covering production, inventory, procurement, logistics, quality, and service strategies.

- Create a financial plan, including income statements, balance sheets, cash flow statements, capital expenditure plans, and key performance indicators (KPIs).

- Distribute the corporate targets for sales and spend across product and geography hierarchies, ensuring clarity on objectives for marketing and sales teams.

- Align and communicate the AOP throughout the organization, seeking approval from senior management and the board of directors.

- Execute and monitor the AOP throughout the year, making necessary adjustments based on changing market conditions and customer feedback.

Who within a CPG company is involved in AOP finance?

Within a Consumer Packaged Goods (CPG) company, several key stakeholders typically participate in the AOP finance process. The specific roles and individuals involved may vary depending on the organization’s structure and size. Here are some common stakeholders:

- Chief Financial Officer (CFO): who provides strategic guidance, ensures financial feasibility and aligns the AOP with the overall financial goals of the company.

- Finance Department: They gather and analyze financial data, forecast revenues, and expenses, and provide insights to support decision-making.

- Executive Leadership: Including the CEO, COO, and other C-suite executives, provide guidance and input into the AOP process, ensuring alignment with overall business objectives.

- Sales and Marketing Teams: They contribute insights into customer demand, the competitive landscape, and promotional activities.

- Operations and Supply Chain: They help ensure the AOP is realistic and feasible from an operational standpoint.

- Category Managers: They contribute to the AOP by providing insights into product performance, pricing strategies, and category-specific goals.

- Cross-Functional Collaboration: AOP finance involves collaboration across various departments, including finance, sales, marketing, operations, supply chain, and category management.

How is AOP finance different from a budget?

AOP finance is a broader financial planning process that encompasses goal-setting, strategic alignment, and resource allocation, while a budget is a more specific, detailed plan that focuses on the allocation of financial resources within a defined timeframe. The AOP process provides a strategic framework for developing and executing budgets to achieve desired financial outcomes.

- AOP Finance provides a comprehensive overview of the organization’s financial goals, strategies, and resource allocation for that specific period. On the other hand, a budget is a detailed financial plan that outlines expected revenues, expenses, and cash flows for a specific period, which could be monthly, quarterly, or annually.

- AOP finance allows for more flexibility and adaptability compared to a budget. While a budget is typically based on fixed assumptions and estimates.

- AOP finance emphasizes the alignment of financial goals with broader organizational strategies. In contrast, a budget is primarily concerned with the allocation of funds to different cost centers and departments based on historical data and future projections.

-

While the finance department prepares and senior management approves the budget, the scope of involvement expands significantly when it comes to an annual operational plan (AOP). The AOP typically incorporates input from various employees, department heads, and stakeholders across the organization.

FAQs

What does AOPA stand for?

AOPA Finance refers to the financial planning and budgeting process conducted by the Aircraft Owners and Pilots Association (AOPA). It involves creating a comprehensive plan and budget to guide the organization’s financial activities for a specific period.

What does AOP stand for in finance?

AOP finance means, in simple terms, “Annual Operating Plan”. It refers to a detailed projection outlining an organization’s anticipated revenues, expenses, and goals for the upcoming fiscal year, aiding in strategic decision-making and budgeting.

AOP meaning in banking – “Annual Operating Plan,” is a detailed financial roadmap outlining projected revenues, expenses, and strategic goals for a bank’s upcoming fiscal year, guiding budgeting and operational decisions.

AOP acronym finance meaning –The acronym “AOP” can stand for various things, depending on the context. In finance, it commonly refers to “Annual Operating Plan,” outlining projected financials for a specific period, aiding in budgeting and decision-making.

How do Budget and AOP finance work together?

Budgets and operating plans are essential financial tools that complement each other and aid organizations in efficiently managing their finances and meeting their objectives. By utilizing these tools together, organizations can ensure optimal utilization of resources to effectively achieve their goals.

By integrating the budget and operating plan, organizations can secure the necessary resources for successful strategy execution.

- Integration ensures that resources are utilized effectively to accomplish goals.

- The budget provides financial allocation and control, while the operating plan outlines how resources will be utilized to achieve objectives.

- Together, these tools optimize resource management and enhance overall organizational performance.

What is the role of RGM in the AOP finance process?

Finance plays a crucial role in the AOP process by setting revenue and profit targets, allocating resources and budgets, evaluating financial feasibility, and monitoring performance and changes throughout the year.

Revenue Growth Management (RGM) is a strategic function that uses data-driven insights and analytics to maximize a company’s revenue and profitability by informing decisions on pricing, promotions, assortment, and trade investments.

The main objective of Revenue Growth Management (RGM) is to optimize sales and marketing strategies by considering target markets, customer segments, channels, products, prices, promotions, and distribution strategies. RGM evaluates ROI, identifies best practices, and learns for future optimization.

Role of field sales

The sales team plays a vital role in the AOP process by facilitating communication, negotiation, and compliance with the plan. They gather feedback, adapt the plan to market dynamics, and collaborate with customers to achieve mutual goals.

In the AOP finance process, sales teams receive top-down targets for sales and spending. They develop bottom-up promotional strategies for their accounts and collaborate with finance and RGM to align plans. Building strong customer and retailer relationships is also crucial.

Recap:

The Annual Operating Plan (AOP Finance) is a comprehensive analysis of a company’s financial situation, including revenue, expenses, growth projections, and market trends. It involves stakeholders from various departments who collaborate to create a budget and plan aligned with strategic objectives. After approval by the board of directors, the plan is implemented and monitored throughout the year, with adjustments as needed.

AOPs provide a structured approach to financial management, ensuring effective resource utilization, informed decision-making, risk management, and financial stability amidst market changes. They are valuable tools for businesses, enabling goal setting, progress tracking, and resource allocation.

Read more:

- What is Digital Transformation in the Banking Industry

- How to Build an Effective Financial Transformation Roadmap

- Digital Transformation in Business: Trend| Future| Benefits

- What is E-commerce Business Intelligence: Tools for BI

- What is Business Process Transformation?

- Business Planning Process and Types of Business Strategy

- Types of Business Organizations | Private Limited Companies

- Digital Marketing Budget Allocation | Effective Allocation Strategies

- Best Financial Digital Transformation Services: Trend | Future

- Boost Your Sales with Digital Shelf Optimization

- Everything You Need to Grow Your SaaS Business

- What should be the Format of a Business Plan| 8 Top Factors