Types of Business Organizations | Private Limited Companies

Types of business organizations – Making crucial decisions is a necessary part of starting a business, especially when choosing the best business structure. Making the greatest decision possible for your circumstances may be aided by taking the time to investigate your options and comprehend how other businesses operate. In this post, we go through the different types of business structures, their benefits and drawbacks, and how to pick the best one for your requirements.

Table of Content:

- What is a Business Organization?

- Private sector business organization:

- The Sole Trader:

- Partnerships

- Private Limited Companies:

- Public Limited Companies:

- Factors Affecting the Choice of Organization:

What is a Business Organization?

Businesses are often referred to as organizations. An Organisation is a body that is set up to meet needs. For example, the ST. John’s Ambulance organization was originally set up by volunteers to train the public in life-saving measures.

These types of business organizations satisfy needs by providing people with goods and services. All organizations will:

Try to achieve objectives:

- use resources

- need to be directed

- have to be accountable

- have to meet legal requirements

- have a formal structure

6 Types of Business Structures:

- Sole proprietorship.

- General partnerships.

- Limited liability partnership.

- Limited partnership.

- Limited liability company.

- Business corporations.

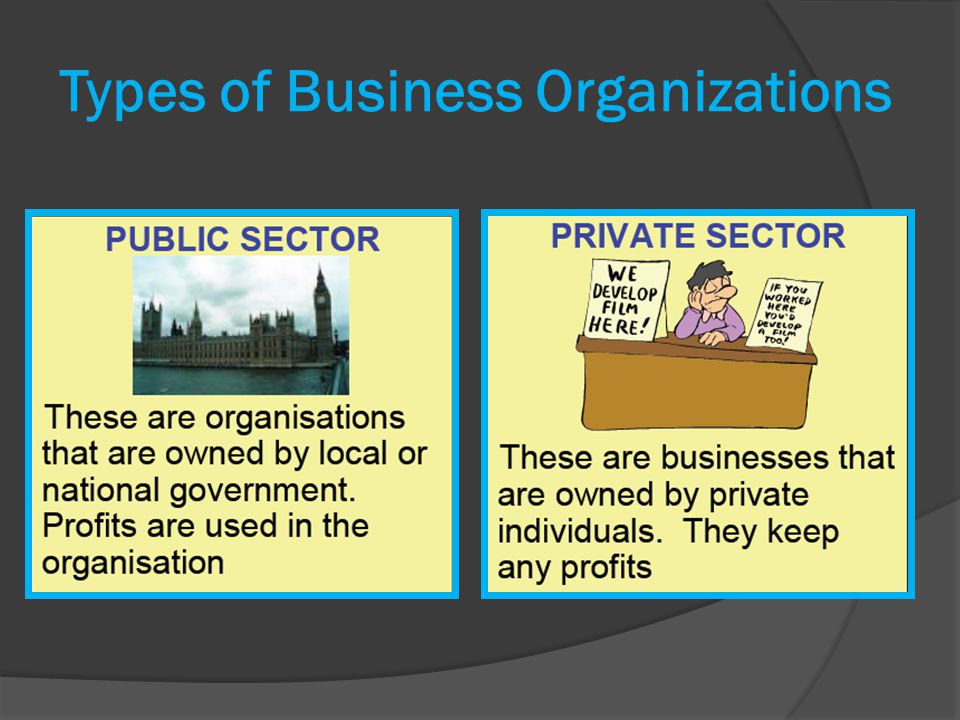

Private sector business organization:

All companies founded by individuals or groups of individuals fall within the private sector. The private sector conducts the majority of business. The types of business organizations in the private sector can vary considerably. Some of them are modest businesses with just one owner. Others are large multinational companies, such as Exxon Mobil and Cadbury Schweppes Business will vary according to the legal form they take and their ownership.

Unincorporated firms – These are companies where the owners and the company have the same legal status. The owner or owners’ names are used in everything. These businesses are frequently small and have just one owner or a small number of partners.

Incorporated business – An incorporated body is one that has a separate legal identity from its owners. In other words, the company is subject to lawsuits, takeover attempts, and liquidation.

The Sole Trader:

A sole trader or sole proprietorship is the most basic and typical type of private-sector enterprise. These types of business organizations are owned by just one person. The business is run by the owner, who may have a large staff.

Solo traders’ types of business organizations can be found in different types of productions. Many farmers and fishermen carry out their operations in the primary sector. There are small-scale manufacturers, builders, and construction companies in the secondary sector. The tertiary sector probably contains the largest number of sole traders.

They offer a variety of services, including hairstyling, retail, dining, gardening, and other home services. Many solo traders exist in retailing and construction where a very large number of shops and small construction companies are each owned by one person. Although there are many more solo traders than some other types of business organizations, the amount they contribute to total out in the UK is relatively small.

Setting up as a sole trader is straightforward. There are no legal formalities needed. However, sole traders or self-employed dealers do have some legal responsibilities once they become established. In addition, some types of business organizations need to obtain special permission before trading.

- Sole traders must register for VAT whenever their annual revenue reaches a certain threshold.

- Income tax and National Insurance contributions are due from them.

- Some types of business activity need a license, such as the sale of alcohol or supplying a taxi service or public transport.

- Sometimes planning permission is needed in certain locations. For example, a person may have to apply to a local authority for planning permission to run a fish and chip shop on premises that had not been used for this activity before.

- Laws governing business conduct must be followed by sole traders. For instance, they are required by law to give their employees a safe and healthy work environment.

Sole Traders Advantages:

These types of business organizations aa s sole traders that can take individual customers’ needs into account, stocking a particular brand of a good or making changes to a standard design, one the sole trader examples. There are some sole trader advantages and disadvantages:

- The lack of legal restrictions. The sole proprietor won’t have to deal with a drawn-out setup process or high administrative fees.

- The owner keeps any after-tax profit.

- The owner has total authority and is unrestricted in his or her decision-making. Independence is a primary motivator for many lone proprietors to launch their businesses.

- The owner has the flexibility to choose the hours of work he or she wants and to take holidays. Customers may also benefit.

- Due to their modest size, sole proprietors can provide their clients with personalized service. Some people would rather communicate with the owner directly and are willing to pay more for the privilege.

- These types of business organizations/companies might be eligible for government assistance.

Sole Trader Disadvantages

These types of business organizations, are frequently tiny and lack sufficient collateral—such as real estate or land—to get loans. This implies that funds for expansion must be obtained from earnings or savings. Although independence is an advantage, it can also be a disadvantage A solo trader might prefer to share decision-making, for example.

- Sole traders have Unlimited Liability. This implies that the owner is personally responsible for any obligations incurred by the company. A sole proprietor could have to sell their personal belongings or use their funds to pay off these debts.

- Frequently, the owner’s savings were utilized to launch the business. Another source could be a bank loan. It could be challenging for sole proprietors to raise capital.

- Many single proprietors put in a lot of overtime, don’t take any days off, and may need to pick up new skills.

- In cases where the owner is the only person in the business, illness can stop business activity from taking place. For example, if a sole trader is a mobile hairdresser, the illness will lead to a loss of income in the short term and even a loss of customers in the long term.

- Due to the fact that sole traders are unincorporated enterprises, in the event of a disagreement, the owner may be held liable.

- One person’s aptitude and zeal may be all that the company needs. If that person loses interest or dies then the business will cease.

Partnerships – Types of Business Organizations:

A partnership is normally defined as “the relationship which exists between persons going on business with a common objective to profit” in The Partnership Act of 1890. Simply said, a partnership has multiple owners. The “joint” owners will split the profits and the management costs of the company.

Partnerships in business are often found in the professions, such as accountants, doctors, estate agents, solicitors, and veterinary surgeons. After sole traders, partnerships are the most common types of business organization. It is usual for partners to specialize. A firm of chartered accountants with five partners might find that each partner specialise in one aspect of finance, such as tax law, investments, or VAT returns.

When a partnership is established, there are no legal procedures to follow for these types of business organizations. A Deed of Partnership, however, may be written by the partners. This is a legal document that outlines the rights of the partners in the event of a disagreement. It covers issues such as:

- how much capital each partner will contribute

- how the partners will allocate profits and losses

- the procedure for ending the partnership

- how much control each partner has

- the rule for taking on new partners

The Partnership Act will apply to the agreements between partners if no deed of partnership is created. For example, if there was a dispute regarding the share of profits. the Act states that profits are shared equally amongst the partners.

Partnership Business Advantages

Partners can share the workload. They can also exchange ideas and opinions when making key decisions. Additionally, unlike a lone proprietor, the success of these types of organizations will not depend on the skills of one individual.

- There are no formalities that must be completed in order to launch the firm.

- Each partner can specialize. This may improve the running of the business, as partners can carry out the tasks they do best.

- Since there is more than one owner, more finance can be raised than if the firm was a sole trader.

- Since these types of business organizations tend to be larger than the sole trader, it is in a stronger position to raise more money from outside the business.

Disadvantages of Partnership:

Any choice made by one partner on behalf of the business is enforceable against the other partners. For example, if one partner agreed to buy four new company cars for the business, all partners must honor this.

- The individual partners have unlimited liability. Each partner is jointly and severally liable for debts under the Partnership Act.

- More owners must share in the profits.

- Partner may disagree. For example, they might differ in their views on whether to hire a new employee or about the amount of profit to retain for investment

- 20 partners are the maximum number that can be in a partnership. This restricts the sum of money owners may provide.

- When one of the partners passes away, the partnership dissolves. the partnership must be wound up so that the partner’s family can retrieve money invested in these types of business organizations. It is normal for the remaining partners to form a new partnership quickly afterward.

- Due to the unincorporated nature of partnerships, partners are subject to customer lawsuits.

Limited partnerships – Types of Business Organizations:

Although it is uncommon, the Limited Partnerships Act of 1907 permits a business to become a limited partnership. In this scenario, some partners contribute capital but don’t manage the company. A limited liability partnership is one that is only liable for the amount they first invested. She can not be made to sell personal possessions to meet any other business debts. A sleeping buddy is a name for this kind of companion.

There must always be at least one partner with unlimited liability, even in a limited partnership. The Act also permits a partnership of this type to have more than 20 partners.

A limited liability partnership may be formed in accordance with the Limited Liability Partnership Act of 2000. In this sort of partnership, each partner is only partially liable. To set up a limited liability partnership, the business has to agree to comply with a number of regulations, such as filing annual reports with the Registrar of Companies.

One limited partnership example – Although limited partnerships are used in a number of commercial contexts, they are likely most frequently utilized in family-run establishments like restaurants.

Companies – Types of Business Organizations:

In the UK, there are numerous instances of limited companies. They range from the modest family business Garrick Engineering to British Airways, which has hundreds of stockholders. One feature is that all have a separate legal identity from their owners. As a result, they are able to possess property, make agreements, hire individuals, and bring and defend legal actions. Another feature is that the owner all have Limited Liability.

If a limited company incurs obligations, the owners are only liable for their initial investment. Unlike sole proprietors and partners, these types of business organizations like companies, cannot be made to use their personal funds to settle business debts.

The shares that make up the limited company’s capital are divided. Each number or shareholder owns a number of these shares. They have voting rights and are entitled to a portion of the company’s profits as joint owners. Those with more shares will have more control and can make more profit.

Directors of limited liability businesses are chosen by the shareholders. The board of directors, headed by a chairperson, is accountable for shareholders’ wishes. If the company’s performance does not live up to shareholders’ expectations, directors can be ‘voted out’ at an Annual General Meeting (AGM).

Whereas sole traders and partnerships pay income tax on profits, companies pay corporations tax.

Forming a Limited Company:

How do shareholders set up a limited company? The Memorandum of Association and Articles of Association are two documents that limited businesses are required to produce.

The Memorandum describes the company and outlines its constitution. According to the Companies Act of 1985, the following information is required.

- The name of the Company

- The company’s registered office’s name and address

- The company’s goals and the range of its activities

- The liability of its members

- How much capital needs to be raised and how many shares need to be issued

There is no maximum number of members required for a limited corporation, however, there is a minimum of two.

The internal operations of the corporation are covered by the Articles of Association. These types of business organizations include details such as:

- a shareholder’s rights based on the sort of share they own

- the methods for selecting directors and the extent of their authority

- the number of terms before reelection that directors should serve

- the timing and frequency of company meeting

- the arrangements for an auditing company account

These two documents, along with a statement indicating the name of the directors, will be sent to the Registrar keeps these documents on file and they can be inspected at any time by the general public for a fee. A limited company must also submit a copy of its annual account to the Register each year. Finally, the shareholders have a legal right to attend the AGM, and they should be informed in writing well in advance of the date and location.

Private Limited Companies:

PVT types of business organizations are one type of limited company. They tend to be relatively smaller businesses, although certain well-known companies, such as Reebok and Littlewoods, are private limited companies. Shares can only be transferred “privately” and all shareholders must consent to the transfer of their company name ends in Limited or Ltd. They cannot be advertised for general sale.

Private Limited companies types of business organizations are often family businesses owned by members of the family or close friends. These companies’ directors frequently participate in the management of the company as shareholders. Many manufacturing firms are private limited companies rather than sole traders or partnerships. There are some private limited company advantages and disadvantages are:

Advantage:

- shareholders have limited liability. As a result, more people are prepared to risk their money than in, say a partnership

- Since there is no cap on the number of stockholders, more money can be obtained.

- It is impossible for outsiders to gain control of the business. Share can only be sold to new members if all shareholders agree

- Even if one of the owners passes away, the company will still operate. In case share will be transferred to another owner

Disadvantages:

- There must be a much larger number of members who split the profits.

- The business must be established legally. This is time-consuming and expensive.

- Firms are not allowed to sell shares to the public, Which restricts the amount of capital that can be raised

- Anyone in the public has the right to look into financial information submitted to the Registrar. This could be advantageous for rivals.

- Finding a buyer for shares that one shareholder decides to sell could take some time.

Public Limited Companies:

These types of business organizations tend to be larger and are called PLCs. This company name ends in PLC. There are around 1.8 million registered limited companies in the UK, but only around 1% of them are public limited companies. However, they contribute far more to national output and employment are more people than private limited companies. On the stock exchange, the general public can buy and sell shares of these corporations.

To become a public limited company, A memorandum of Association, Articles of Association, and s Statutory Declaration must be provided.

This is a document that states that the requirements of all the Company Act have been met. When These types of business organizations, have been issued with a Certification of Incorporation, it is common to publish a Prospectus.

This is a document that advertises the company to potential investors and invites them to buy shares before a Flotation. The online bank Egg is an illustration of a business that has been listed on a stock exchange. The Egg was floated by Prudential in 2000. It was suggested that Tussauds, Europe.s biggest attraction, responsible for the running of Madame Tussaud’s waxworks, the London Eye and Alton Tower, would be floated in early 2004. The majority owner, Charterhouse Development Capital, was aiming to sell it for around 900 pounds million.

Going public is expensive. This is because:

- To make sure the prospectus is ‘legally’ correct, the company needs lawyers.

- It is necessary to make a lot of “glitzy” publications available.

- the company may use a financial institution to process share application

- The business might employ a financial institution to handle share application processing.

- The share offering must be insured, which requires the firm to purchase insurance against the potential that some shares would remain unsold. An underwriter will be paid a fee, who must buy any unsold shares

- The business will incur marketing and administrative costs.

- it must have a minimum of 50,000 pounds of share capital

These requirements must be fulfilled before a public limited company can start trading, and these types of business organizations must also get at least a 25% payment for the value of its shares. It will then receive a trading Certificate and can begin operating, and the shares will be quoted on the Stock Exchange or the Alternative Investment Market (AGM).

A market where used shares are purchased and sold is the stock exchange. When a company is fully listed on the stock exchange, it is required to abide by all stock exchange policies. Many of these regulations exist to safeguard shareholders from fraud.

The AGM is designed for companies that want to avoid some of the high costs of a full listing. However, shareholders with shares quoted on the AGM do not have the same protection as those with ‘fully’ quoted shares.

Advantages:

Some of the advantages of these types of business organizations are the same as those of private limited companies. For example, all members have limited liability, the firm continues to trade if one of the owners dies and more power is enjoyed due to their larger size. Others are as follows:

- The public sale of shares can generate enormous sums of money.

- PLCs frequently rule the market due to their scale.

- As financial institutions are more inclined to lend to PLCs, raising capital is made easier.

Disadvantages:

- The expenditures of starting up can be quite high, often reaching millions of pounds.

- Since anyone can purchase their shares, it’s conceivable for a third party to control the business.

- The public has access to view every account for the business. Some of this information may be useful to rivals for their own gain. Compared to private limited corporations, they are required to publish more information.

- They are unable to interact personally with their customers due to their size.

- Their operations are governed by a number of Company Acts, all of which are designed to safeguard shareholders.

- There could be a separation of ownership and control, which could result in a partial disregard for the owners’ interests.

- Many of these businesses are said to be rigid because of their size; for instance, they have a hard time adjusting to change.

Some of these types of business organizations like public limited companies are very large indeed. They have millions of shareholders, as well as a wide range of international corporate interests. they are known as multinationals which means that they have production plants in a number of different countries.

For example, Kellogg’s is an American-based multinational company with a production plant and head office situated in Battle Creek, USA. Kellogg’s has also had factories in Manchester, Wrexham, Berman, Barcelona, and Brescia near Milan.

Exiting the Stock Market:

Sometimes a business operating as a public limited company is taken back into private ownership. This may be called ‘exiting the stock market’/ Why does it happen?

It’s possible that those in charge of running the company won’t put up with any more intervention from outside shareholders. When senior managers would want to reinvest profits to spur further growth, for instance, shareholders like financial institutions may demand bigger payouts.

Sometimes businesses lose favor with the stock market. This might occur, for instance, if city analysts release unhelpful or unfavorable reports about businesses not meeting their profit goals. Such publicity frequently has the result of dramatically decreasing the share price.

A business currently operating as a plc may be bought outright by a private individual. For example, Philip Green, bought Bhs, the high street clothes retailer, from Storehouse in 2000. He also bought Aradia in 2002 for a reported 770 pounds million. Both of these companies were part of a plc organization until purchased.

Holding Companies:

Some public limited types of business organizations operate as Holding Companies. This means that they are not only a company in their own right, but also have enough shares in numerous other public limited companies to exert control. This type of company tends to have a very diversified range of business activities> For example, in the UK the TTP Group plc is a holding company for a number of technology businesses.

These include TTP LabTech, which supplies products to the healthcare and pharmaceutical sectors, and Acumen Bioscience which develops and provides screening instruments for the drug discovery industry.

The main advantage of these types of business organizations is that it tends to have a diverse range of business activities. This helps protect it when one of its markets fails. Also, because it is so large, it can often gain financial economies of scale. The main disadvantage is that the holding company may see the businesses it owns only as a financial asset. It might not have a long-term stake in the company’s growth or operations.

More than one operational business may be contained within a holding company structure. The operating firm is owned by the holding company, which in turn is owned by the entrepreneur. Risk can be shared in this way. You work with the running company to conduct business.

Consumer co-operatives:

The initiatives of 28 workers in Rochdale gave rise to the UK Co-operative Movement. Lancashire. The Rochdale Equitable Pioneers Organisation, a retail co-operative society, was founded in 1844. With a capital of just 28 pounds, they bought food from wholesalers and opened a shop, selling ‘wholesome food at reasonable prices.

Members of the society received a “dividend” in the form of the surplus (or profit) that was made. Each member received a dividend based on how much they had spent. The principles of the society were:

- voluntary and open membership

- democratic ownership – one member, one vote

- the surplus allocated according to spending ( the dividend)

- educational facilities for members and workers.

The principles of these types of business organizations, and the modern co-operatives movement are similar. Consumer Co-Operatives are usually organized on a regional basis, such as The West Midlands Co-op Society or the Southern Co-op. Members of cooperatives own and govern the organization. Shares that grant members the right to vote at annual general meetings are available for purchase. The members elect a board of directors to make overall business decisions and appoint managers to run the day-to-day business.

Cooperatives are managed with the members’ best interests in mind. Members can put themselves forward to be elected to the board of directors and become involved in a range of different activities, such as help for local community groups. A dividend is given to members of the cooperative for any excess that is made. The quantity of money that can be raised is constrained because shares cannot be traded on the stock exchange.

The world’s largest consumer co-operative is The Co-operative retail Group. This was set up in 2000 by the joining of two organizations:

- The Co-operative Retail Society (CRS) in Manchester, the largest co-operative retailer at the time

- The Co-operative Wholesale Society (CWS), acted as a manufacturer and wholesaler of ‘own brand’ products for cooperative retailers.

Consumer co-operatives types of business organizations often have a number of different activities.

Food retail activities – Perhaps the most familiar activity of co-operatives is the co-operative retail food store. Co-operative retail stores have faced fierce competition from supermarkets in recent years.

They have responded by offering convenience stores that stay open later and may be sited in rural locations, such as Chelmsford (Altogether Fresher and Food Centres shops run by Chelmsford Star Co-op) or Coventry, Warwickshire, and Leicestershire. Some are now starting to offer online shopping.

Worker co-operatives:

One of some types of business organizations of co-operation in the UK common ownership is a Worder Co-Operative. This is where a business is jointly owned by its employees. A worker co-operative is an example of a producer co-operative – where people work together to produce a good or service. Examples include a cooperative of winemakers or a group of farmers who produce milk.

In work co-operative employees are likely to:

- contribute of production

- be involved in decision making

- share in profit (usually on an equal basis)

- Invest some money while purchasing stock in the company.

In 2000, there were over 1,000 worker co-operatives in the UK. Examples ranged from Alpha Communications Ltd, a multimedia design company, to Edinburgh Bicycle Cooperative, a cycle retailer.

One advantage of a worker co-operative is that all employees, as owners of the business, are likely to be motivated. Conflict will also tend to be reduced as the objectives of shareholders and employees will be the same. Worker co-operatives can involve the local community, either by giving donations to local bodies or even by having them as members of the co-operative.

Building and Friendly Societies:

Mos building societies and friendly societies in the UK are Mutual organizations. They are owned by their customers or members as they are known, rather than shareholders. Profit goes straight back to members in the form of better and cheaper products. Friendly societies began in the 18th and 19th centuries to support the working classes. Today friendly societies offer a wide range of ‘affordable’ financial services.

These types of business organizations include savings schemes, insurance plans, and protections against the loss of income or death. They also provide benefits such as free legal aid, sheltered housing, or educational grants to help young people through university. These extra benefits are distributed free of charge and paid for by trading surpluses. The government gives friendly societies special tax treatment, which reduces the amount of tax that members pay.

On the other hand, Building societies types of business organizations used to specialize in mortgages and saving accounts. Saver and borrowers got better interest rates than those offered by banks. this way is possible because building societies were non-profit making.

In the late 1990s a number of building societies, such as Halifax, Alliance and Leicester, and Northern Rock, became public limited companies. The main reason for this was that mutual organizations are restricted by law from raising large amounts of capital that might be used to invest in new business ventures. This demutualization process involved societies giving members ‘windfall’ payments, usually in the form of shares, to compensate them for their loss of membership.

Charities:

Charities are types of business organizations with very specialized aims. They exist to bring awareness to the concerns of underprivileged groups in society and raise funds for “good” causes. For example, Age Concern is a charity that raises money on behalf of senior citizens. They also raise awareness and pass comments on issues, such as cold weather payments, which relate to the elderly. Other examples of national charities include Cancer Research Campaign, British Red Cross, Save the Children Fund, and Mencap.

Charities rely on donations for their revenue. They also organize fundraising events such as fetes, jumble sales, sponsored activities, and raffles. A number of charities run business ventures. For example, Oxfam has a chain of charity shops that sells second-hand goods donated by the public.

Charities types of business organizations are generally run according to business principles. They try to keep expenses to a minimum, promote themselves, and hire workers. While volunteers make up the majority of personnel, some of the larger organizations do hire professionals.

In the larger charities, a lot of administration is necessary to deal with huge quantities of correspondence and handle charity funds. Charities are exempt from paying taxes as long as they are registered. Businesses can also deduct any charitable contributions they make from their taxes, this helps charities when raising funds.

Franchises:

If a person wants independence but is better at carrying out or improving someone else’s ideas than their own, Franchise types of business organizations might be the ideal solution. Franchising has grown steadily. It was estimated that the annual turnover of franchisees in the UK was around 7 pounds Billion in 2000. There were around 550 business format franchises in 2000. Over 90% of franchisees reported that they were trading profitably.

There are many examples of franchised types of business organizations in the UK. Franchise opportunities UK – They include names such as Wimpy, Dyno-rod, Body Shop, and Holiday Inn. What types of Franchise exist?

Dealer franchise – These are used by petrol companies breweries and vehicle and computer producers. The companies (the franchisors) agree that other businesses (the franchises) can sell their product.

A written agreement between the two will cover areas such as the backup service of the franchisor, maintaining the image of the franchisor, sales targets, stock levels, and the ‘territory’ of the franchisee. For instance, Ford Motor Company does not permit dealers to advertise outside the designated “region” or to have more than 5 dealerships. Ford does not charge a fee. It earns revenue by a mark-up on sales to the dealer.

Brand franchising – These types of business organizations are designed to allow an inexperienced franchisee to set up from scratch. It is used by businesses such as Wimpy and McDonald’s. The franchisor will already be known for a certain commodity or service. It “sells” the franchisee the rights to these branded goods.

The intention is that a consumer will know they are buying the same product whether in London or Edinburgh. It is important that franchises are mentored to make sure that the standard is maintained. To buy the franchise a business will pay an initial fee, sometimes a deposit, and then an ongoing fee which is often a percentage of turnover (a royalty of, say, 10%). The franchisor frequently handles marketing, public relations, and other support functions.

- using the specialist skills of a franchisee (in the case of Ford dealers’ retailing skills).

- the market grows without the company expanding

- a consistent amount of income (because royalties are based on turnover not profits, money is guaranteed even if a loss is made by the franchisee)

In these types of business organizations – Risk and uncertainty are shared, the advantage to franchises might be:

- The franchisor might nationally advertise and market the product

- The likelihood of failure is lower because they are marketing a well-known product.

- The franchisor may provide services like administration and training.

Franchising is not without its problems. Even if a loss is realized, the royalty must be paid. Also, rather than operating their own company, franchisees may just serve as “branch managers”, due to limitations in the contract The franchisor has the power to withdraw the agreement and in some cases, prevent the franchisee from using the premises in the future.

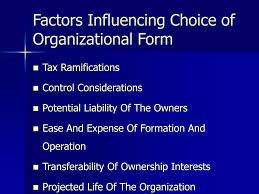

Factors Affecting the Choice of Organization:

Age – As they get older, a lot of firms change their legal status. Most businesses when they start out are relatively small and operate as sole traders. Over time, as needs change, a sole trader may take on a partner and form a partnership.

Alternatively, a sole trader may invite new owners to participate in the business, issue shares and form a private limited company. Public limited companies are often formed from established private limited companies that have been trading for many years.

The need for finance – In these types of business organizations, a change in legal status may be forced on a business. Often small businesses want to grow but do not have the funds. Additional finance can only be raised if the business changes its status. Furthermore, many private limited companies ‘go public’ because they need to raise large amounts for expansion.

Size – A company’s legal standing is likely to change depending on how big it is. A great number of small businesses are usually sole traders or partnerships. Public limited companies tend to be large organizations with thousands of employees and a turnover of millions or billions of pounds. It could be argued that a very large business could only be run if it were a limited company.

For example, certain types of business organizations, such as oil processing and chemicals manufacturing, require large-scale production methods and could not be managed effectively as sole traders or partnerships.

Limited liability – If the company is a limited company, the owners can safeguard their own financial situation. Sole traders and partners have unlimited liability. Therefore, they might be forced to utilize their own funds to make ends meet. business debts. Some types of business organizations, partnerships dealing with customers’ money, such as solicitors, have to have unlimited liability in order to retain the confidence of their clients.

Degree of Control – Owners may consider retaining control of their business to be important. That is why many owners choose to remain as sole traders. Once new partners or shareholders become a part of the business the degree of control starts to diminish because it is shared with the new owners. It is possible to keep some control of a limited company by holding the majority of shares. However, even if one person holds 51% of shares in a limited company, the wishes of the other 49% cannot be ignored.

The nature of the business – Activities of these types of business organizations, may influence the choice of legal status. For example, household services such as plumbing, decorating, and gardening tends to be provided by sole traders. Professional services such as accountancy, legal advice, and surveying are usually offered by partnerships. Private limited companies are frequently used by family-owned and very modest manufacturing businesses. Large manufacturers and producers of consumer durables, such as cookers, computers, and cars, are usually PLCs. The reason that these activities choose a particular type of legal status is because of the benefit they gain as a result. However, there are many expectations to these general examples of these types of business organizations.

Forms of Business Organizations: Advantages-

Partnership-

A corporate partnership can be categorized as either general or limited.

- Simple to establish

- A partnership can pool expertise.

- Spread out workload

Corporation-

A corporation is a type of corporate entity that operates independently of its stockholders.

- Owners aren’t responsible for business debts

- Tax exemptions

- Quick capital through stocks

Sole proprietorship-

This well-liked business structure is the simplest to establish.

- Total control of the business

- No public disclosure required

- Easy tax reporting

- Low start-up costs

Cooperative-

A cooperative, sometimes known as a co-op, is a privately owned company, institution, or farm that is managed by a number of people to achieve a shared objective.

- Greater funding options

- Democratic structure

- Less disruption

Limited liability company-

These types of business organization -A limited liability corporation, or LLC, is the most typical type of corporate structure for small firms. An LLC is regarded as a separate legal entity and is allowed to have an unlimited number of owners.

- Limited liability

- Pass-through taxation

- Flexible management

What to Read Next:

Forms of business ownership – the different types of business organizations – A type of business organization – what type of business organization generates – what type of business organization generates the most sales- what type of business organization generates the most total sales – business organization examples – texas business organizations code – types of business organizations