New Texas Business Organizations Code: LLC vs Corporation-B: 1203

The Texas Business Organizations Code automatically became applicable to the majority of filing entities on January 1, 2010. For further details on how this modification can affect your company,

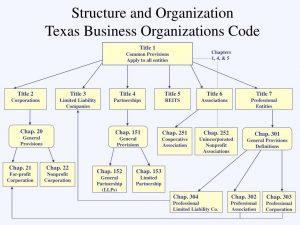

The following laws have been repealed and replaced by the Texas Business Organizations Code (BOC):

- Act on Business Corporations in Texas

- Act on Non-Profit Corporations in Texas

- Professional Corporation Act of Texas

- Professional Association Act of Texas

- Act Concerning Various Corporation Laws in Texas

- Texas Real Estate Texas Revised Limited Partnership Act

- Texas Cooperative Association Act and Investment Trust Act

- Uniform Unincorporated Nonprofit Association Act Texas

- Revised Partnership Act

The BOC is applicable to all Texas corporations, partnerships, limited liability companies, and other domestic filing entities as well as all international filing entities registered to conduct business in Texas as of the mandatory application date of January 1, 2010. No matter when an entity was founded or whether it actively sought to embrace the BOC, the BOC nonetheless applies to that entity.

When was the Texas business Organizations Code enacted?

In 2003, the BOC came into effect. Although it offered a transition period in which some entities were regulated by the BOC and others were governed by the statutes under which they were founded, it became effective on January 1, 2006, though, it offered a period of transition where certain entities were regulated by the BOC and others were governed by the legislation under which they were created. The BOC currently rules over all entities once the previous legislation was repealed on January 1, 2010, though.

New Texas Business Organizations Code:

The 87th Texas Legislature, Regular Session (the “2021 Legislative Session”), which began on January 12, 2021, and ended on May 31, 2021, approved a number of significant laws altering the Texas Business & Commerce Code (TBCC) and the Texas Business Organizations Code (TBOC) (TBCC). Unless otherwise stated, the legislation is detailed below and went into effect on September 1, 2021.

B. 1203, Omnibus Business Organization Code Amendments.

The TBOC was amended by this bill in terms of domestic corporations, partnerships, and limited liability firms in both substantive and technical ways. It specifically contains improvements to business entities’ operational capacities during emergencies or disasters, advances entity administration capabilities, and offers procedural changes intended to assist operations to run more smoothly.

B. 1523, LLC Registered Series:

B. 1523, LLC Series registered. as of June 1, 2022. This bill permits limited liability corporations to employ protected and registered series. The TBOC now distinguishes between “registered series” and “protected series,” following the Delaware model, as of the 2021 Legislative Session. When a series has the choice to register with the state, it can take care of any extra documentation that could be required in certain sorts of transactions. The series may yet continue as a protected series if it does not require that kind of official state documentation and the original format is sufficient.

B. 1280, Securities Act Corrections:

starting on January 1, 2022. With the deletion of cross-references that could be interpreted incorrectly as linking TSA provisions that do not impose any obligations on private actors to TSA private civil remedy provisions, this bill makes technical adjustments to the Texas Securities Act (TSA), which has been recorded.

B. 873, Purchase of a business – Comptroller Tax Disclosure:

This law deals with the comptroller’s obligation to disclose the amount of taxes owed to a business buyer. The measure now specifically states that the comptroller must submit this information on an affidavit or in “other form stipulated by the comptroller.”

B. 3131, Certificates of Formation – Address:

The original postal address of the filing entity must now be known and included as a new condition for the certificate of formation for a new entity under this bill.

B. 6, Pandemic Liability Shield:

This law deals with several claims that surfaced during a pandemic or a pandemic-related calamity.

B. 1578, Recovery of Attorney’s Fees in Civil Cases overview:

By adding limited liability companies, partnerships, and almost every other type of business entity to the definition of business organizations, this measure altered Section 38.001 of the Texas Civil Practice and Remedies Code to permit the recovery of legal expenses in contract disputes. This development is significant because Texas courts would have rigorously interpreted 38.001 to allow attorney’s fees recovery against only people or businesses previous to this modification.

About O’Connor’s Texas Business Organizations Code Plus Book, 2021-2022 ed.

The complete Business Organizations Code, the Texas Securities Act, and a few provisions from the Texas Business and Commerce Code, Texas CPRC, and Texas Administrative Code are all included in O’Connor’s Texas Business Organizations Code Plus, along with the most recent case annotations—case quotations that explain or apply a specific code section.

Aside from bill analyses from significant legislation that has an impact on the Texas Business Organizations Code, this work also includes charts, suggested readings for business organization practice, and a tonne of cross-references to relevant statutes, regulations, forms, and secondary sources.

- ProView eBook – $185.00

- Monthly pricing – $14.00/month

What is texas business Organizations code LLC?

A limited liability company (LLC) is a type of private company that combines aspects of partnerships and corporations in the United States. Pass-through entities include LLCs. As a result, the LLC’s income is distributed directly to its shareholders for personal income tax purposes.

LLC vs Corporation Taxes – Texas Business Organizations Code

An LLC is owned by one or more people, whereas a corporation is held by its stockholders, and this is the primary distinction between an LLC and a corporation. Whichever entity you select, your firm will gain significantly from both options. It is possible to build credibility and professionalism by incorporating a firm.

If an LLC is taxed as a pass-through entity, each member is responsible for paying taxes on their portion of the earnings, regardless of whether the money is retained by the company or transferred to their personal accounts. Owners of C corporations, on the other hand, are only taxed on the dividends they actually receive.

FAQ:

I need a copy of the Texas Business Organizations Code and other statutes; can the secretary of state give it to me?

The Texas Business Organizations Code and other statutes cannot be obtained from the secretary of state. The Texas Legislature Online website and law library both offer access to statutes. Legal publishers may be able to provide paper copies.

What the mean Texas Business Organizations Code Nonprofit?

Any corporation that does not provide any of its money to its members, directors, or officers is referred to as a “nonprofit corporation.”

Any legitimate reason or purposes that are not expressly forbidden by this chapter or Chapter 2, such as any purpose listed in Section 2.002, maybe the basis for the formation of a nonprofit company.

Texas Business Organizations Code – BUS ORG § 1.001. Purpose explained:

This code’s goal is to increase the clarity and accessibility of the law it governs by:

(1) reordering the laws in a more sensible sequence;

(2) using a format and numbering scheme that makes it easy to cite the legislation and allows for future legal extension;

(3) repealing redundant, out-of-date, executed, or other ineffective clauses; and

(4) To the fullest extent practicable, restating the law in contemporary American English.

Texas Business Organizations Code – BUS ORG § 2.001. General Scope of Permissible Purposes:

DEFINITIONS, Section 1.002. Within this code:

(1) A person who controls, is controlled by, or shares control with another person is referred to as an affiliate.

(2) “Associate,” when referring to a personal connection.

(3) An entity controlled as an association under Title 6 or 7 is referred to as an “Association.” Cooperative associations, charitable associations, and professional associations all fall under this umbrella phrase.

(4) An “assumed name” is a name that a person uses.

(5) A trade, occupation, profession, or other commercial activity is referred to as a “business.”

What is Texas BOC?

The following laws have been repealed and replaced by the Texas Business Organizations Code (BOC): Act on Texas Corporations. Non-Profit Corporation Act of Texas Professional Corporation Act of Texas. Professional Association Act of Texas.

What is Texas LLC?

Limited liability corporations (LLCs) are commercial entities that shield your personal assets from debts incurred by your business. Additionally, an LLC provides a flexible management structure and some tax advantages.

What is Texas Business Organizations code dissolution?

You must submit a Certificate of Termination to the Secretary of State in order to dissolve your Texas LLC. The filing fee is $40. You can submit the form online. You can engage us to dissolve your LLC for you if you’d like to save some time.

What to Read Next:

Texas business organizations code llc – texas business organizations code dissolution – business organization code texas – business organization code texas – texas business organization code-

texas business code – texas boc – tboc